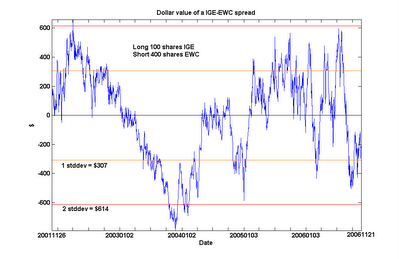

Many of us Canadians like to think of our economy as a member of the advanced, post-industrial world, with the landscape dotted with brand-name companies such as Nortel Networks, Research In Motion, and Four Seasons Hotels. In the back of our minds, of course, we know we are also a resource-rich country. But still, it may come as a bit of an embarrassment to find out that, of all the sector index funds we can compare the MSCI Canada Index fund EWC to, it cointegrates only with the natural resource index fund IGE. Even the financial sector indices do not come close, despite the presence of numerous financial services companies in the Canada Index. As usual, in the chart below, I plotted the spread between 100 shares of IGE and 400 shares of EWC, and we can see for ourselves how this spread stubbornly sticks close to zero.

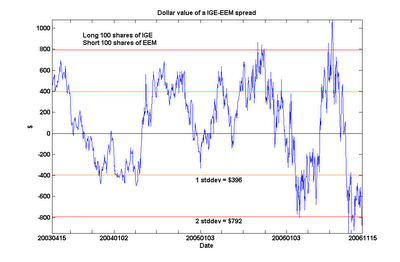

One may note that IGE also cointegrates with the Emerging Markets index fund EEM. (The chart below is the spread between 100 shares of IGE and 100 shares of EEM.)

This is not surprising. But does this imply the unsettling conclusion that the Canadian economy cointegrates with the emerging markets? No. I will not bore you with yet another chart: just be assured that cointegration is not a transitive relation.

This is not surprising. But does this imply the unsettling conclusion that the Canadian economy cointegrates with the emerging markets? No. I will not bore you with yet another chart: just be assured that cointegration is not a transitive relation.

This is not surprising. But does this imply the unsettling conclusion that the Canadian economy cointegrates with the emerging markets? No. I will not bore you with yet another chart: just be assured that cointegration is not a transitive relation.

7 comments:

EC-

the reason Canada correlates with emerging markets is due to- natural resources. If u look at some of the most sought after EM they are resource based- from Brazil to Africa. Especially with Brazil, since TSX is 60% resource based...at least that's why the correlation exists in my view

Yaser: yes, Canada does cointegrate with natural resources, as the first chart shows. But it actually doesn't cointegrate with emerging markets, based on my calculations. The presence of financial services companies throw this off-course, I think, as the typical EM have few financial powerhouses in their index.

EC

EC- my bad I misread.

EC- What do you make of the arbitrage opportunities in HET and PD's stock prices from their buyout bids? As you know I've written about them but I lack the expertise of arbitraging, maybe when you have time you could talk about how you would have taken advantage of them in your hedge fund days or even now.

Thanks a lot.

Yaser: the situation you described is "risk arbitrage" -- usually studied and traded in a different department in an investment bank from the "statistical arbitrage" trades that I am familiar with. Usually those of us in stat arb avoid buyout situations like the plague -- because we don't know how to analyze fundamentals! All we know how to do is to analyze historical price relationships. Nevertheless, I will take a look at this pair and see if I have any useful comments. Thanks for the suggestion!

Ernie

Hi,

first thanks for your great page. It really sparked my interest for cointegration and that stuff... matlab is already installed and I have the econometrics package ready.

So, I tried to follow your numbers in, however I get different figures. What does that "number of lags" mean? and do you normalise the stock price before or can one directly enter the stock prices of the two shares you want to compare..

and last: do you then take the number of lags which fits best as your result..?

Sorry for the many questions, maybe you can help me.

Thanks in advance,

Henning

Henning: There is no normalization for stock prices in my calculations. The number of lags (number of past periods to use in an autoregressive model for the prices) should be at least one, but can be more. If you have further questions, please feel free to email me. -Ernie

Post a Comment